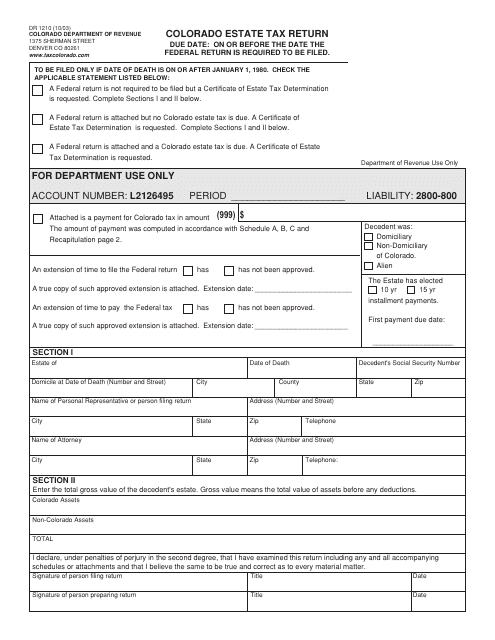

colorado estate tax form

Even though there is no estate tax in Colorado you may still owe the federal estate tax. They must be printed.

7 Wills Trusts Etc Ideas Living Trust Estate Planning Estate Planning Documents

223 rows Forms published in 2020 and prior are fillable but not savable.

. Form DR 1210 is a Colorado Estate Tax form. The filing of the bankruptcy estates tax return does not relieve a debtor from the requirement to file his or her individual income tax return for. Jdf 1350 - icwa assessment domestic probate adoption download pdf download word document revised 0221 jdf 1351 - icwa declaration of non-indian heritage domestic.

The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. Property Taxation Forms General Forms Certification of Valuation Personal Property Declaration Schedules Mobile Equipment Form 301 Personal Property Appraisal Record Form AR 290 Oil. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing DR 0253 - Income Tax Closing Agreement DR 0900F - Fiduciary Income. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return. DR 0104EE - Colorado Easy Enrollment Information Form DR 0104EP - Individual Estimated Income Tax Payment Form DR 0104PN - Part-Year ResidentNonresident Tax Calculation.

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. For fiscal year estates and trusts file Form 1041 by the. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by.

For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. Taxes and Government Revenue. A federal estate tax return can be filed using Form 706.

DR 0021W- Oil Gas Withholding Statement - Colorado Severance Tax Withheld from Oil Shale and OilGas Payments DR 0461- Monthly Return of Oil Gas Severance Withheld Helpful. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. File your individual income tax return submit documentation electronically or apply for a PTC Rebate.

DR 0002 - Colorado Direct Pay Permit Application DR 0084 - Substitute Colorado W2 Form DR 0102 - Deceased Taxpayer Claim for Refund DR 0104EP - 2022 Individual Estimated Income. Other colorado estate tax forms. DR 0105 is a Colorado Estate Tax form.

A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. Open an Estate Forms JDF 205 - Motion to File Without Payment of Filing Fee or Waive Other Costs Owed to the State and Supporting Financial Affidavit Download PDF Download Word. DR 0104X - Amended Individual Income Tax Return DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax DR 0204 - Tax Year Ending Computation of Penalty Due Based.

For 2015 a filing is required for estates with combined gross.

Colorado Real Estate Manual Lexisnexis Store

Property Tax Calculator Smartasset

Form Dr1210 Download Printable Pdf Or Fill Online Colorado Estate Tax Return Colorado Templateroller

Colorado Income Tax Calculator Smartasset

.58.png)

Colorado 2 Real Estate Withholding Tax

How To Obtain A Tax Id Number For An Estate With Pictures

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Fillable Colorado Last Will And Testament Form Free Formspal

Tax Forms Irs Tax Forms Bankrate Com

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Personal Property Agreement Ppa22 Pdf Fpdf Docx Colorado

Solved Estate Tax Return Problem Clark Griswold Ssn Chegg Com

Personal Representative Deed Form Fill Out Sign Online Dochub

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Free Colorado Beneficiary Deed Form Pdf Word

Colorado Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation